Over the last 5 decades, the number of Americans living in multigenerational households has quadrupled, according to a recent survey by Rocket Mortgage Research. More than 59 million people live in multigenerational households or a home that includes two or more adult generations, with 48.8% of respondents opting to live with family to save money.

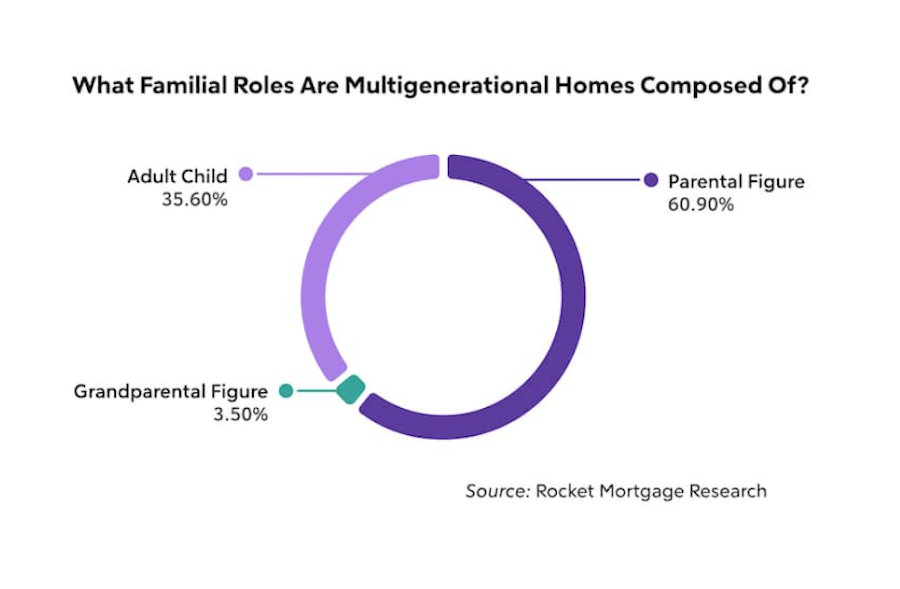

Parents with adult children accounted for the most common dynamic represented in the survey, with 60.9% of respondents identifying their primary role as a parent or parental figure and 35.6% identifying as an adult child. According to Rocket Mortgage, just 3.5% of those surveyed identified their main role as a grandparent or grandparental figure.

While the majority of respondents reported living in a multigenerational household due to affordability concerns, 31.2% of those surveyed said they wanted to spend more time with family, and 27.9% were doing so to provide care for older family members.

Of the 48.8% who said financial reasons were the main reason for multigenerational living, housing costs were the predominant concern. In fact, 40.2% of those respondents attributed their decision to share a home with family to either: the expensive housing market in their area (21.6%) or the need for multiple incomes to afford their home (18.6%). Meanwhile, 33.9% said saving money is too difficult without the additional support of multiple incomes supporting the household. Interestingly, only 5.2% of those surveyed cited reduced cost of older adult care as a primary factor and just 2.5% cited childcare as their main motivation (7.7% in total).