The latest findings for Q3 2017 suggest the increase in demand is fueled by rental and home price inflation, and is moderating the housing market slowdown.

In the third quarter, 78 percent of first-time homebuyers used a low-down payment product, up five percent from Q3 2016. The low-down payment mortgage market had its highest level of demand from first-time homebuyers since the third quarter of 1999, and supply has increased, according to Genworth Mortgage Insurance's latest market report.

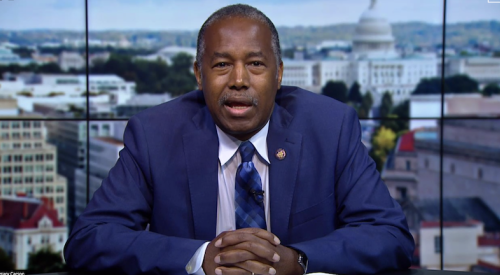

First-time homebuyer growth is shifting the mortgage industry landscape in favor of the private sector. The private mortgage insurance industry was again the fastest-growing source of credit enhancement for first-time homebuyers within the mortgage industry. In contrast, the FHA program is beginning to contract.