First-time homebuyers may need assistance qualifying and securing mortgages for a variety of reasons. The following programs provide assistance to this buying cohort.

The Federal Housing Administration (FHA) works with local lenders to offer mortgages to people who may not qualify to get them anywhere else. Lenders, in turn, typically offer such federally-backed mortgages to first-time homebuyers without the strongest credit history, thereby cushioning their potential return, SmartAsset reports. Debt is a common obstacle for first-time homebuyers, yet those with debt-to-income ratios around 55 percent are still able to qualify for an FHA loan, as long as two years have passed since the borrower experienced bankruptcy.

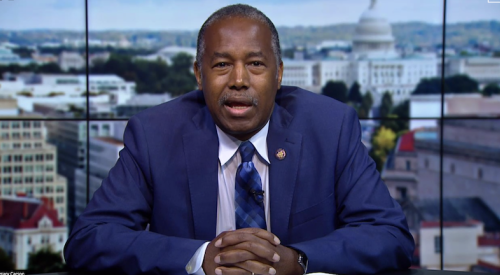

Neighborhoods owe a lot to their teachers, police officers and other public servants. The Teacher Next Door program helps these people stay in their local communities by helping them pay off their homes ... It’s sponsored by the U.S. Department of Housing and Urban Development (HUD). Teachers, police officers, firefighters and emergency service technicians can get 50 percent discounts off the list price for homes in “revitalization areas.” Those areas are designated by HUD.