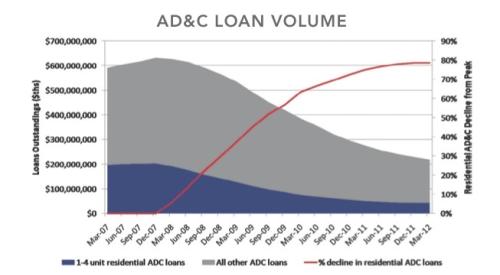

The volume of residential construction loans has seen 20 consecutive quarters of growth, with a 1.8 percent increase in the first quarter of 2018.

According to the NAHB’s Eye on Housing blog, the rise is due to a slowly growing inventory in the loans available for residential construction. The current loan stock is up 7 percent from one year ago, though today’s stock is still 63 percent lower than the first quarter of 2008.

Despite the steady increase in residential AD&C lending, there exists a lending gap between home building demand and available credit. This lending gap is being made up with other sources of capital, including equity, investments from non-FDIC insured institutions and lending from other private sources, which may in some cases offer less favorable terms for home builders than traditional AD&C loans.