The housing market is at an inflection point, with high inflation, interest rates on the rise and housing affordability in decline. Supply chain disruptions are driving up the cost of building materials, with high lumber costs alone adding thousands of dollars to the price of a new home. The cost of land and labor also remain high, and burdensome regulations account for nearly 25% of the price a typical new home.

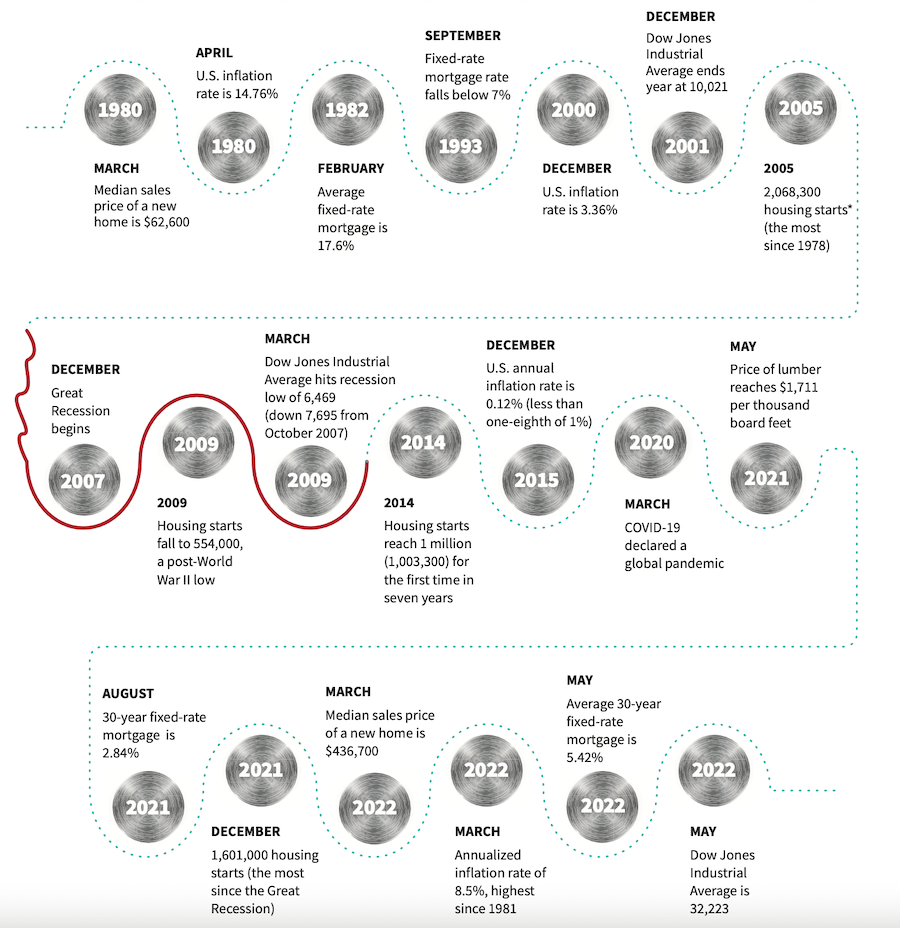

With society attempting to return to normal from a global pandemic and the Federal Reserve trying to quell inflation without causing a recession, it is hard to forecast what is next for the U.S. economy. To better understand how current events and economic conditions may affect the future, it is helpful to see the interplay of key events and economic markers over the last four decades.