A late provision added to the GOP tax plan would give real estate investors a new break, providing a 20 percent deduction on taxable income for pass-through companies.

Under the tax change, all commercial properties qualify for the lower pass-through rate—including hotels, casino, and office buildings. In the construction industry, Redfin reports that the tax change might encourage apartment building projects again as there may be more demand from investors.

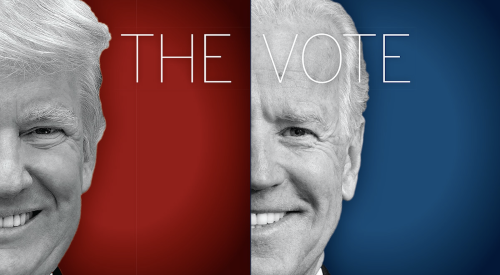

Ultra-wealthy real estate investors are the first beneficiaries of the tax provision, but anyone who invests in rental real estate may also stand to benefit. This includes President Donald Trump, and other policymakers like Senator Bob Corker of Tennessee, who voted against an earlier version of the legislation and on Friday said he’d support the revision.