Mortgage rates for 30-year fixed loans rose to roughly 6% in June, up from a little over 3% one year ago, but according to Nadia Evangelou, senior economist and director of forecasting at the National Association of Realtors (NAR), a fast-paced market is slowing down, and so too will home price growth in the near future. Elevated mortgage rates are pricing out a larger share of buyers and causing a substantial reduction of home sales activity nationwide.

As a result, buyers planning to sell or refinance in the next five years could benefit from adjustable-rate mortgages (ARMs), but first-time and lower-income buyers are still likely to face fierce competition from institutional investors scooping up a large number of affordable homes.

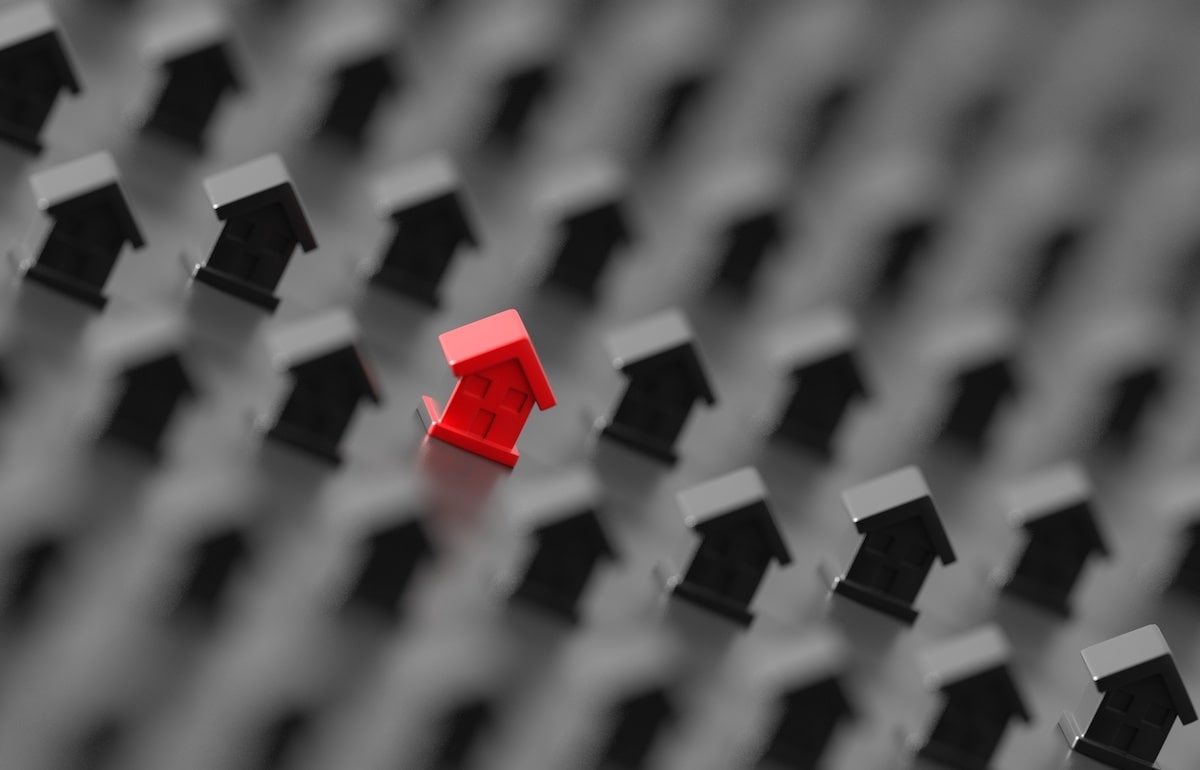

“Due to a housing shortage, home prices won’t drop in 2022. Remember that when there is a housing shortage, home prices don’t fall, in fact, home prices rose about 15% in May, although mortgage rates were about two percentage points higher than a year earlier,” says Evangelou.

There are about 20,000 more homes available for sale for buyers earning $200,000. “While it’s promising to see more homes available in the market, more entry-level homes are needed,” says Evangelou.