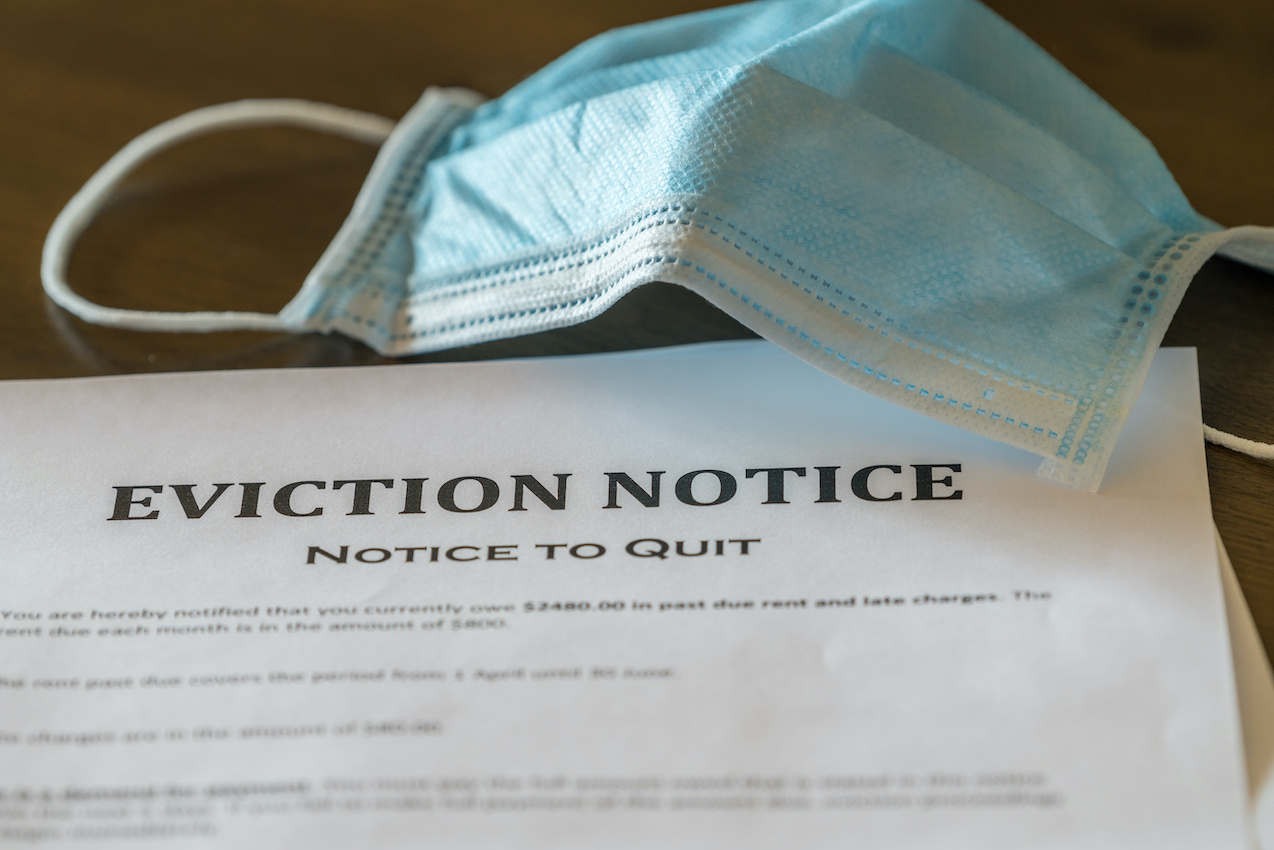

While federal and local eviction moratoriums are protecting many from eviction, there remains a large number of renters who have been unable to pay their rent since March. Closing businesses have pushed more renters into unemployment and into a state of financial ruin. According to Realtor.com, the moratoriums are set to expire in January, or sooner, leaving $7.2 billion in rent debt. About 12.8 million Americans will owe an average of $5,400 in missed rent payments. The effects of these missed rent payments are sure to affect a large portion of the population and affect the broader economy, Realtor.com says.

Even the larger figure would be far less than what was lost when the $1.3 trillion subprime-mortgage bubble burst, leading to a national wave of defaults and foreclosures. But the tens of millions of people potentially caught in a web of home-rental debt and eviction would far exceed the 3.8 million homeowners who were foreclosed on in 2007-2010.

The ballooning debt issue for renters is another sign of how Covid-19 is punishing the less well-off far worse than the more affluent.

Most Americans financially secure enough to own a home are feeling flush, despite the economic downturn and a high unemployment rate that has spared most white-collar professionals. Houses are selling at record rates, and home prices have rarely been higher. Recently moribund suburban-housing markets in the Northeast and other regions have sprung back to life as buyers seek more space while working at home.