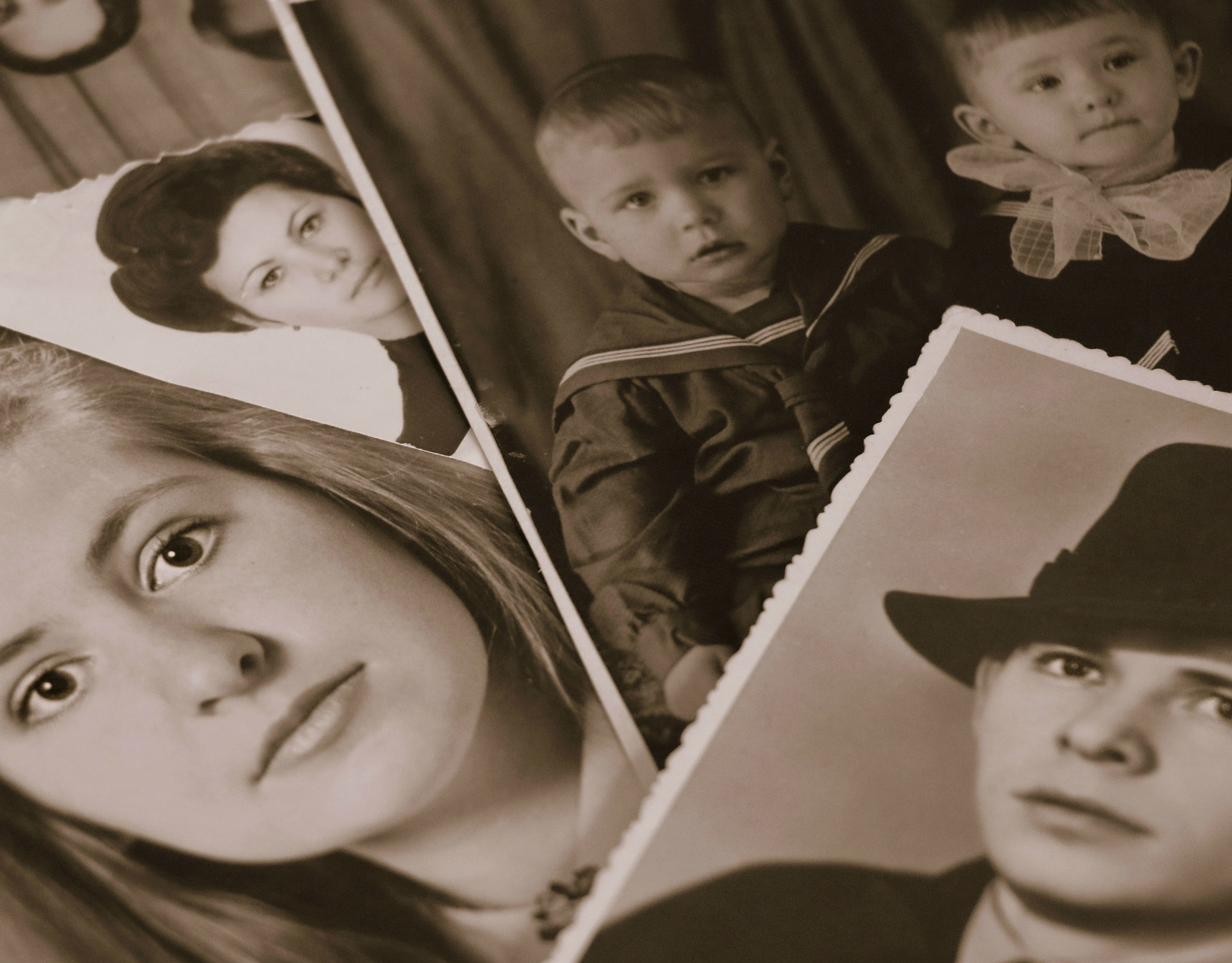

If you’ve been in the housing industry for even a short while, you’ve probably heard of John Burns. A prodigious speaker, regularly appearing on national TV and in other media, Burns attends more than a dozen industry events each year, presenting housing market updates, forecasts, and trends. His firm, John Burns Real Estate Consulting, collects data from all of the major MSAs and conducts boots-on-the-ground research, analyzes it, and turns it into demographic information that companies can use to help inform their strategy (Image: Klimkin via Pixabay).

Drawing on his 25 years’ experience in real estate research and consulting, Burns, along with the firm’s VP and chief demographer, Chris Porter, published a book in late 2016 called Big Shifts Ahead: Demographic Clarity for Businesses. Its content includes a deep dive into our country’s changing population, generation by generation: who they are, how they will live, and where they will live.

In the book, Burns and Porter jump right in and break with tradition, redefining generations by decade of birth as opposed to the traditional 20-to-25–year spans. This new generational delineation has the benefit of focusing in on groups of people who have far more in common with one another than they do with individuals who could be more than 20 years apart in age. Burns and Porter then proceed to break out each group’s members into their respective life stages in terms of where they are generally in their careers, family situations, and financial capabilities, all of which serves to bring more clarity to a company’s target markets.

The authors then offer their assessment of where home builders’ biggest opportunities within those groups may lie. For example, by 2025, the oldest group, those over the age of 65, will have 18 million more members than in 2015. The largest ever five-year age group consists of young adults born in the years 1989 to 1993. This group will factor greatly in increasing the number of households by 12.5 million within the next 10 years.

Across all groups, women offer a tremendous amount of potential as buyers. They currently earn 58 percent of all college degrees in the U.S., and 38 percent earn more income than their spouses. Foreign-born buyers—many of whom come to this country for well-paying jobs—also provide upside potential for builders. If immigration continues at its current pace, the number of foreign-born residents in the U.S. will reach 52 million by 2025, or one out of every seven people.

What kind of housing will these buyers want? Burns and Porter predict that many of them will be living in rentals. They assert that due to affordability issues and limited supply, 7.3 million of the 12.5 million net new households created over the next decade will rent. However, these rentals will encompass a whole range of housing types; apartments, sure, but also single-family homes.

They also say that those who do buy will likely buy smaller homes on smaller lots. Where? According to the book’s authors, the answer may be in “surban” areas, a term Burns and Porter use to describe communities of smaller homes in highly populated areas offering the best of both urban and suburban life. Such areas are springing up mainly in older suburban cities that are being revitalized with lively downtowns and new types of residential development.

I have to admit that viewing Millennials as a monolithic group didn’t make a lot of sense to me. Burns says he felt the same way when he realized his high school–age daughter was in the same group as Mark Zuckerberg. After 9,000 hours of research, the team came up with not only a better idea for how to define the generations but also new perspectives on how they will live their lives.