Single-family rent prices in the U.S. have seen sustained growth between 2010 and 2017, but slowed down year-over-year from November 2016 to November 2017, according to new index data.

The CoreLogic Single-Family Rent Index (SFRI) found that overall growth in November 2017 was weighed down by the high-end rental market, properties price 125 percent or more than an area's median price, which had an increase of 2.3 percent year-over-year. In November 2016, high-end rentals saw 1.6 percent growth. Rent prices for properties on the low-end market, rents less than 75 percent of the area's median rent, rose 3.8 percent year-over-year, down from a gain of 5 percent in November 2016.

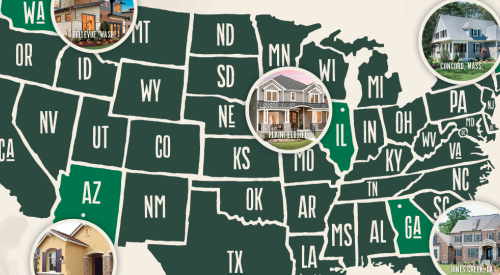

Seattle-Bellevue-Everett, Wash., had the highest year-over-year rent growth with an increase of 5 percent. Only two CBSAs among this group of 20 showed a decrease in rent prices: Urban Honolulu, Hawaii (-1.6 percent) and Miami-Miami Beach-Kendall, Fla. (-0.2 percent). The November 2017 results for Houston is notable with rent growth of 2.5 percent year over year in November 2017, compared with a decline of 1.5 percent in November 2016.